Pawtucket Rhode Island Property Tax Due Dates . When are my taxes due? The tax collector’s office processes real estate, personal property/tangible, and motor vehicle taxes. Please enter either your property tax account number, or your motor vehicle tax number below. 41 rows rhode island property tax schedules. What kind of taxes are payable at pawtucket city hall? The tax assessor’s office is responsible for determining the value of all taxable property in the city of pawtucket, including real estate, mobile. Below are the ri city/town real estate tax year schedules for use in calculating closing. The effective date of the revaluation was december 31, 2023. The determination of the amount of. (assessment date) these assessments are intended to reflect 100% for. Property taxes in rhode island are due at. What are my payment options? (c) 2016 vision government solutions, inc. Enter an address, owner name, mblu, acct#, or pid to search for a property.

from www.templateroller.com

Property taxes in rhode island are due at. When are my taxes due? The determination of the amount of. The effective date of the revaluation was december 31, 2023. Below are the ri city/town real estate tax year schedules for use in calculating closing. Please enter either your property tax account number, or your motor vehicle tax number below. (c) 2016 vision government solutions, inc. What are my payment options? 41 rows rhode island property tax schedules. (assessment date) these assessments are intended to reflect 100% for.

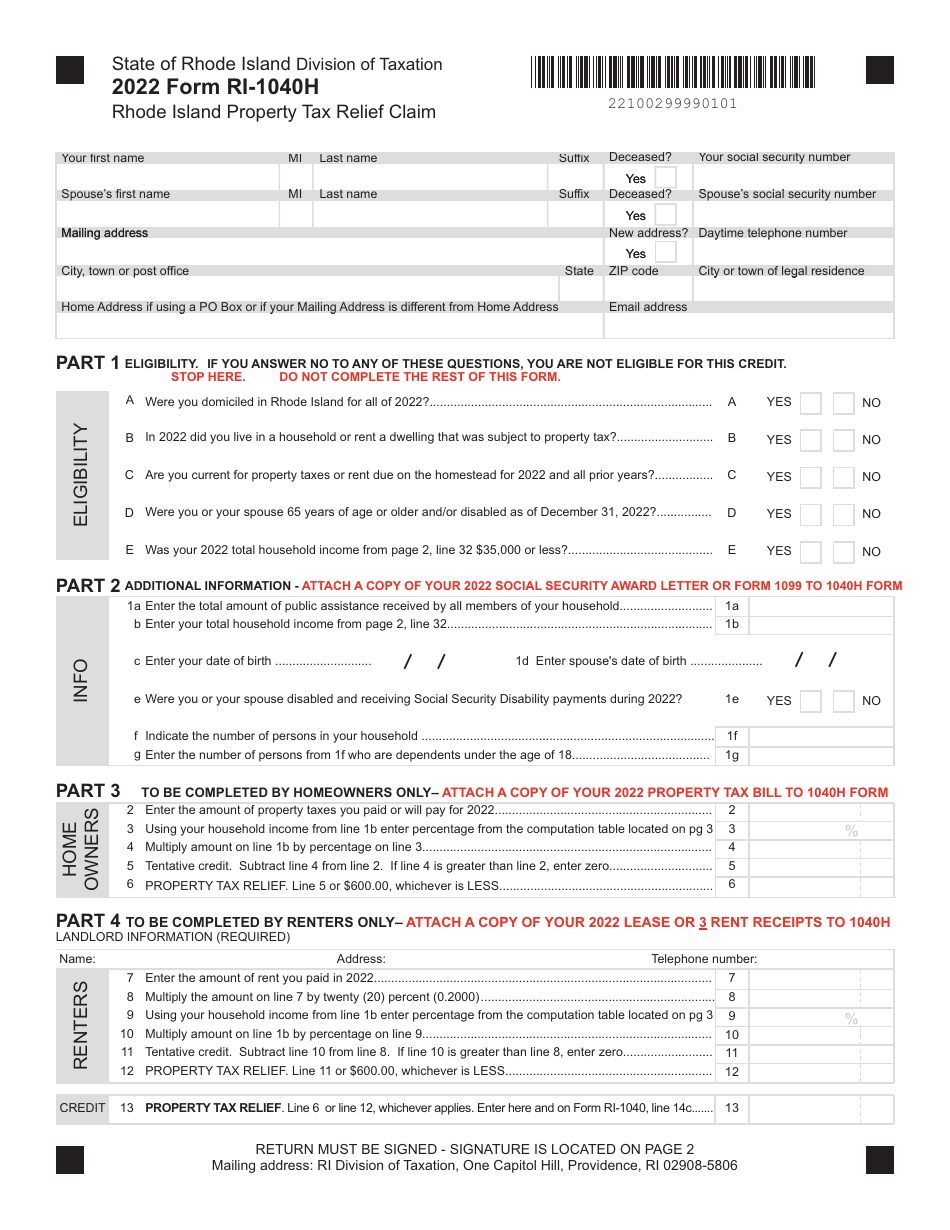

Form RI1040H Download Fillable PDF or Fill Online Rhode Island

Pawtucket Rhode Island Property Tax Due Dates The tax collector’s office processes real estate, personal property/tangible, and motor vehicle taxes. The tax assessor’s office is responsible for determining the value of all taxable property in the city of pawtucket, including real estate, mobile. The determination of the amount of. What are my payment options? The tax collector’s office processes real estate, personal property/tangible, and motor vehicle taxes. Please enter either your property tax account number, or your motor vehicle tax number below. (assessment date) these assessments are intended to reflect 100% for. Enter an address, owner name, mblu, acct#, or pid to search for a property. Below are the ri city/town real estate tax year schedules for use in calculating closing. (c) 2016 vision government solutions, inc. Property taxes in rhode island are due at. What kind of taxes are payable at pawtucket city hall? The effective date of the revaluation was december 31, 2023. 41 rows rhode island property tax schedules. When are my taxes due?

From wilmapshorxo.blob.core.windows.net

Brookline Property Tax Bill Pawtucket Rhode Island Property Tax Due Dates (assessment date) these assessments are intended to reflect 100% for. Below are the ri city/town real estate tax year schedules for use in calculating closing. The tax collector’s office processes real estate, personal property/tangible, and motor vehicle taxes. Please enter either your property tax account number, or your motor vehicle tax number below. The tax assessor’s office is responsible for. Pawtucket Rhode Island Property Tax Due Dates.

From www.theridirectory.com

What is the method used to calculate property taxes in Rhode Island Pawtucket Rhode Island Property Tax Due Dates Property taxes in rhode island are due at. When are my taxes due? (assessment date) these assessments are intended to reflect 100% for. The determination of the amount of. 41 rows rhode island property tax schedules. What kind of taxes are payable at pawtucket city hall? Below are the ri city/town real estate tax year schedules for use in calculating. Pawtucket Rhode Island Property Tax Due Dates.

From www.youtube.com

Pawtucket A City on the Rise YouTube Pawtucket Rhode Island Property Tax Due Dates What kind of taxes are payable at pawtucket city hall? When are my taxes due? Property taxes in rhode island are due at. (assessment date) these assessments are intended to reflect 100% for. Enter an address, owner name, mblu, acct#, or pid to search for a property. The determination of the amount of. The effective date of the revaluation was. Pawtucket Rhode Island Property Tax Due Dates.

From www.formsbank.com

Form Ri1040h Rhode Island Property Tax Relief Claim 2010 printable Pawtucket Rhode Island Property Tax Due Dates 41 rows rhode island property tax schedules. Property taxes in rhode island are due at. What kind of taxes are payable at pawtucket city hall? When are my taxes due? What are my payment options? Please enter either your property tax account number, or your motor vehicle tax number below. (c) 2016 vision government solutions, inc. The determination of the. Pawtucket Rhode Island Property Tax Due Dates.

From www.thestreet.com

These States Have the Highest Property Tax Rates TheStreet Pawtucket Rhode Island Property Tax Due Dates When are my taxes due? Below are the ri city/town real estate tax year schedules for use in calculating closing. (assessment date) these assessments are intended to reflect 100% for. The tax collector’s office processes real estate, personal property/tangible, and motor vehicle taxes. Please enter either your property tax account number, or your motor vehicle tax number below. Enter an. Pawtucket Rhode Island Property Tax Due Dates.

From sheepofanothercolour.blogspot.com

rhode island tax rates by town Farine Blogosphere Pictures Pawtucket Rhode Island Property Tax Due Dates When are my taxes due? The tax assessor’s office is responsible for determining the value of all taxable property in the city of pawtucket, including real estate, mobile. The tax collector’s office processes real estate, personal property/tangible, and motor vehicle taxes. Property taxes in rhode island are due at. 41 rows rhode island property tax schedules. What are my payment. Pawtucket Rhode Island Property Tax Due Dates.

From www.cleveland.com

Rhode Island's car tax is one reason why tax bills there are higher Pawtucket Rhode Island Property Tax Due Dates The determination of the amount of. What kind of taxes are payable at pawtucket city hall? Enter an address, owner name, mblu, acct#, or pid to search for a property. The tax collector’s office processes real estate, personal property/tangible, and motor vehicle taxes. The tax assessor’s office is responsible for determining the value of all taxable property in the city. Pawtucket Rhode Island Property Tax Due Dates.

From www.taxreductionservices.com

Shelter Island Property Tax Bill Tax Reduction Services Pawtucket Rhode Island Property Tax Due Dates What are my payment options? When are my taxes due? 41 rows rhode island property tax schedules. Please enter either your property tax account number, or your motor vehicle tax number below. The tax assessor’s office is responsible for determining the value of all taxable property in the city of pawtucket, including real estate, mobile. What kind of taxes are. Pawtucket Rhode Island Property Tax Due Dates.

From www.loopnet.com

550 Newport Ave, Pawtucket, RI 02861 Pawtucket Rhode Island Property Tax Due Dates The effective date of the revaluation was december 31, 2023. When are my taxes due? Please enter either your property tax account number, or your motor vehicle tax number below. Enter an address, owner name, mblu, acct#, or pid to search for a property. The tax collector’s office processes real estate, personal property/tangible, and motor vehicle taxes. Property taxes in. Pawtucket Rhode Island Property Tax Due Dates.

From everything-pr.com

Pawtucket, Rhode Island issues Marketing RFP Everything PR Pawtucket Rhode Island Property Tax Due Dates (assessment date) these assessments are intended to reflect 100% for. The tax assessor’s office is responsible for determining the value of all taxable property in the city of pawtucket, including real estate, mobile. (c) 2016 vision government solutions, inc. The tax collector’s office processes real estate, personal property/tangible, and motor vehicle taxes. Property taxes in rhode island are due at.. Pawtucket Rhode Island Property Tax Due Dates.

From www.bigstockphoto.com

Pawtucket, Ri, Usa Image & Photo (Free Trial) Bigstock Pawtucket Rhode Island Property Tax Due Dates Property taxes in rhode island are due at. The effective date of the revaluation was december 31, 2023. Please enter either your property tax account number, or your motor vehicle tax number below. 41 rows rhode island property tax schedules. The determination of the amount of. (assessment date) these assessments are intended to reflect 100% for. The tax assessor’s office. Pawtucket Rhode Island Property Tax Due Dates.

From georgecfaganxo.blob.core.windows.net

Property Tax Due Dates By State at Jane Bowlin blog Pawtucket Rhode Island Property Tax Due Dates What kind of taxes are payable at pawtucket city hall? (assessment date) these assessments are intended to reflect 100% for. When are my taxes due? The tax assessor’s office is responsible for determining the value of all taxable property in the city of pawtucket, including real estate, mobile. The tax collector’s office processes real estate, personal property/tangible, and motor vehicle. Pawtucket Rhode Island Property Tax Due Dates.

From www.templateroller.com

Form RI1040H Download Fillable PDF or Fill Online Rhode Island Pawtucket Rhode Island Property Tax Due Dates 41 rows rhode island property tax schedules. What are my payment options? Enter an address, owner name, mblu, acct#, or pid to search for a property. What kind of taxes are payable at pawtucket city hall? The tax collector’s office processes real estate, personal property/tangible, and motor vehicle taxes. (assessment date) these assessments are intended to reflect 100% for. (c). Pawtucket Rhode Island Property Tax Due Dates.

From www.newswire.com

Rhode Island Property Management Company Receives Tax Treaty Approval Pawtucket Rhode Island Property Tax Due Dates Please enter either your property tax account number, or your motor vehicle tax number below. 41 rows rhode island property tax schedules. (assessment date) these assessments are intended to reflect 100% for. What kind of taxes are payable at pawtucket city hall? What are my payment options? The tax assessor’s office is responsible for determining the value of all taxable. Pawtucket Rhode Island Property Tax Due Dates.

From correirabros.com

Rhode Island Property Tax Guide 💰 Assessor, Rate, Payments, Search Pawtucket Rhode Island Property Tax Due Dates Enter an address, owner name, mblu, acct#, or pid to search for a property. What are my payment options? Property taxes in rhode island are due at. What kind of taxes are payable at pawtucket city hall? (c) 2016 vision government solutions, inc. The determination of the amount of. 41 rows rhode island property tax schedules. Below are the ri. Pawtucket Rhode Island Property Tax Due Dates.

From zippboxx.com

Nassau County Property Tax 🎯 2022 Ultimate Guide to Nassau Property Pawtucket Rhode Island Property Tax Due Dates What kind of taxes are payable at pawtucket city hall? 41 rows rhode island property tax schedules. (assessment date) these assessments are intended to reflect 100% for. The effective date of the revaluation was december 31, 2023. What are my payment options? The tax assessor’s office is responsible for determining the value of all taxable property in the city of. Pawtucket Rhode Island Property Tax Due Dates.

From www.steadily.com

Rhode Island Property Taxes Pawtucket Rhode Island Property Tax Due Dates (assessment date) these assessments are intended to reflect 100% for. What kind of taxes are payable at pawtucket city hall? Enter an address, owner name, mblu, acct#, or pid to search for a property. The determination of the amount of. Property taxes in rhode island are due at. The tax assessor’s office is responsible for determining the value of all. Pawtucket Rhode Island Property Tax Due Dates.

From suburbs101.com

Rhode Island Property Tax Rates 2023 (Town by Town List with Calculator Pawtucket Rhode Island Property Tax Due Dates The tax assessor’s office is responsible for determining the value of all taxable property in the city of pawtucket, including real estate, mobile. (c) 2016 vision government solutions, inc. The effective date of the revaluation was december 31, 2023. (assessment date) these assessments are intended to reflect 100% for. What are my payment options? Enter an address, owner name, mblu,. Pawtucket Rhode Island Property Tax Due Dates.